The amount of down payment do you need for a house? How to obtain a house with $0 down in 2020: To start with time customer How to avoid wasting for any house: The whole guideline Buying a house without a great deal of funds Down payment gifts: How to give and get a funds down payment gift for just a home Earnest money Check out, down payment and closing charges: When are they due?

Advantages and disadvantages of different types of homes Condo or house: Which need to I purchase? Warrantable & non-warrantable condo mortgage guidelines current Obtaining a loan with a made home Multifamily homes: Make your house pay for alone ten Making a proposal

When should really I lock my mortgage rate? How to shop for a mortgage and Assess mortgage fees Don’t settle for your very first mortgage fee estimate Exactly what is a mortgage charge lock? five techniques to obtain a reduced mortgage price 13 Submitting Remaining Application Items to the Lender

That can help likely homebuyers put together to the USDA loan approach, the key steps to getting a USDA loan are outlined below.

Indeed. Gifts can be employed presented They can be from the relative, charitable organization, government entity, or nonprofit. Sometimes, a gift from a colleague can be utilized if proof of the connection prior to the loan transaction is usually set up. Applicants receiving a gift will require to finish USDA’s gift letter sort. Download the shape right here.

Ferguson mentioned the band has obtained "sizeable distributions," which aided purchase a fresh travel plaza that should make new Employment and cash flow.

USDA home value loophole. USDA loans let you take out An even bigger loan than the acquisition cost If your appraiser states the home is really worth over you’re shelling out.

No. Potential buyers who definitely have purchased just before may use the USDA program. Nonetheless, borrowers commonly have to market their latest home or prove it’s possibly too far faraway from their do the job or otherwise is no longer appropriate.

Click below to apply for government home loans ohio

Complete and reliable communication through the course of action Rapid responses and closings Lenders at each and every Office environment which will help you directly Loans catered to your person condition Integrity to never ever lock you into a bad healthy Credit score lifestyle and incapacity insurance plan presented Totally free, no-obligation prequalifications

These allowances reduced your eligibility revenue. Take into account, it's not your qualifying money. Just the borrowers about the application may well use their income for debt ratio functions. Such as, if grandma and grandpa Dwell with you and assist you with the costs, their income doesn’t depend for qualifying.

The initial 12 months that phrase restrictions have been enacted was in 1992, and the first calendar year that phrase boundaries impacted the ability of incumbents to operate for Office environment was in 2000. Vacancies

Getting a home in USDA loan parts is just the primary Component of the process. Not every single home passes the USDA appraisal In spite of its place. The USDA assures these loans, so they've got demanding demands concerning which homes qualify.

HomeReady offers versatile underwriting necessities, and, even though You need to spend mortgage insurance plan when you get just one of such loans, it’s generally reduced than you could see with other conventional loans.

Yearly Proportion Amount (APR) calculation is predicated on estimates A part of the table previously mentioned with borrower-compensated finance prices of 0.862% of The bottom loan amount, plus origination fees if relevant. Should the down payment is less than twenty%, mortgage insurance policies can be demanded, which could raise the monthly payment and also the APR.

Even after having an FHA loan, you have the choice to refinance to a traditional loan In the event your credit history score and other things qualify. Then, as you get to 20% fairness on the home, you’ll be eligible to apply for just a removal of one's mortgage insurance policies.

The USDA provides a few diverse loan programs for people to engage in. Each loan program presents anything a little various, and read more you will see which just one suits your preferences and qualifications when You begin the application course of action.

Even underneath normal circumstances, buying a house offers issues of 1 type of A different for buyers. Purchasing a house in 2020 will come with any amount of issues.

A chance to borrow up on the Fannie Mae/Freddie Mac conforming loan Restrict on a no-down-payment loan in the majority of parts—and a lot more in certain significant-Price counties. It is possible to borrow in excess of this volume if you need to generate a down payment. Study VA home loan boundaries

Employment. You'll need not less than 24 months of continual perform to qualify to the USDA home loan. Nonetheless, in the event you go to highschool full-time, This may replace a considerable the greater part of this time period without penalizing you. Revenue Limits. This loan program is suitable for reduced-money households. The exact total varies from point out to state, but customarily You will need to generally be at or under a hundred and fifteen% of your respective area's regional cash flow.

This loan may be ideal for you should you’re Prepared for a method to move towards your intention of proudly owning a home without Placing other parts of your lifetime on keep in an effort to preserve for a substantial down payment.

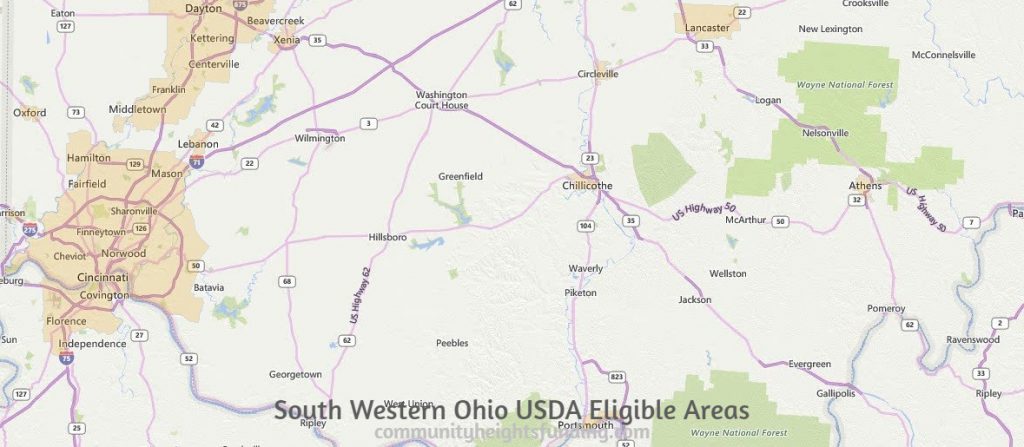

Ohio USDA Eligibility

Editorial Take note: The content material of this short article is predicated to the writer’s views and proposals by itself. It has not been previewed, commissioned or usually endorsed by any of our network companions.

My mortgage is in “processing.†What does a mortgage loan processor do? The best way to decipher the stack of mortgage loan disclosures from your lender Exactly what is title coverage, and is it expected?

No down payment as long as the product sales selling price isn’t bigger compared to the home’s appraised worth (the worth established with the home after an expert reviews the house)

Why use Axos Financial institution®to get or refinance your home? $0 Lender Payment* When your goal is to save money, we might help through discount offers and cashback alternatives. Agile Technologies From the absolutely free fee observe services to our hassle-free on-line application process, you may have usage of the electronic applications you need. Minimal Mortgage Costs Conserve about the life of the loan as a result of our charges, among the lowest from the country.

Given that you already know you will discover choices for buying a home with no down payment, the question continues to be: could it be a good idea?

Alternatively, certain loans are only insured by the government—you need to come across an approved lender who'll actually finance the loan by itself.

HomeReadyâ„¢ is a Fannie Mae loan program which is built to increase the privileges of homeownership to purchasers with constrained household incomes.

“If prospective buyers Have a very down payment program—Particularly a person that features closing Price tag enable—and don’t need to have the vendor to assist with closing prices, they're able to make more eye-catching offers than competing potential buyers,†describes Moss.